Credit Union Cheyenne: Outstanding Participant Providers and Financial Products

Credit Union Cheyenne: Outstanding Participant Providers and Financial Products

Blog Article

Why Cooperative Credit Union Are the Key to Financial Success

Credit history unions have actually emerged as an engaging option for those looking to boost their monetary well-being. With an emphasis on customized solutions and community-driven efforts, credit rating unions stand out as key gamers in fostering monetary success.

Benefits of Signing Up With a Lending Institution

Signing up with a cooperative credit union supplies various benefits that can favorably affect one's financial wellness. One substantial benefit is the feeling of community that debt unions foster. Unlike standard banks, debt unions are member-owned cooperatives, which implies that each member has a voice in how the union operates. This democratic structure frequently leads to a more customized financial experience, with a concentrate on meeting the requirements of the members instead of taking full advantage of profits.

In addition, lending institution frequently give far better customer support than bigger banks. Members commonly report higher satisfaction degrees as a result of the tailored attention they receive. This devotion to participant service can lead to tailored financial solutions, such as individualized loan alternatives or monetary education programs, to assist participants accomplish their financial objectives.

Moreover, being a part of a cooperative credit union can provide accessibility to a range of monetary product or services, typically at even more competitive prices and with lower charges than conventional financial institutions. This can bring about cost financial savings gradually and contribute to total economic stability.

Affordable Rates and Lower Charges

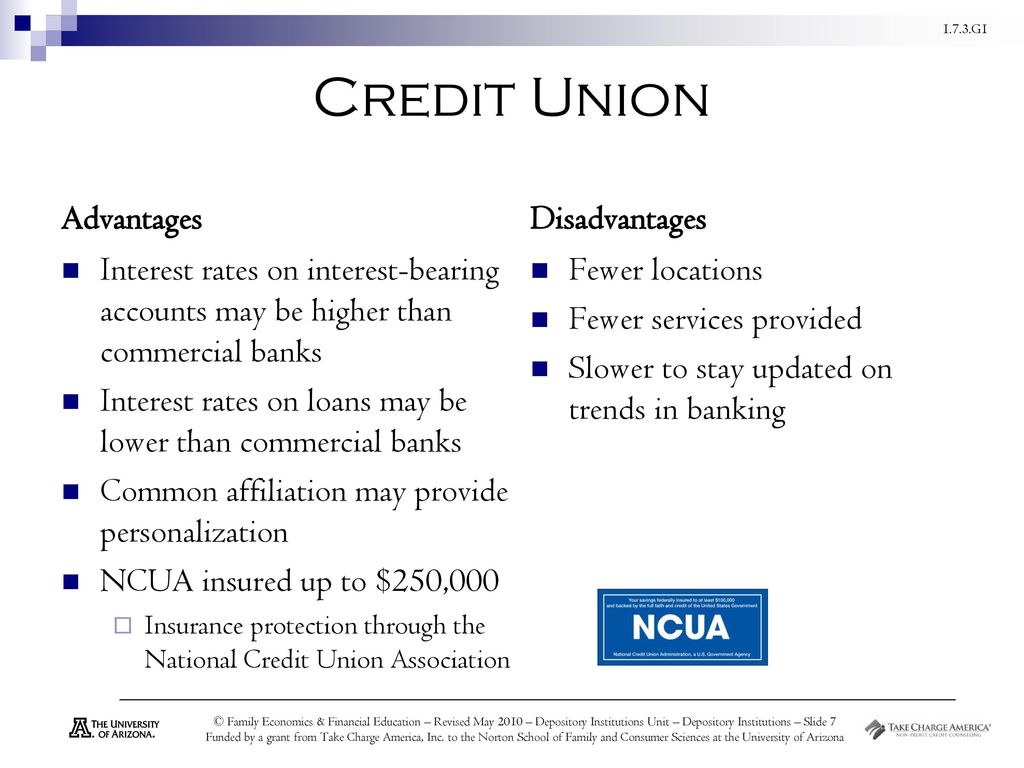

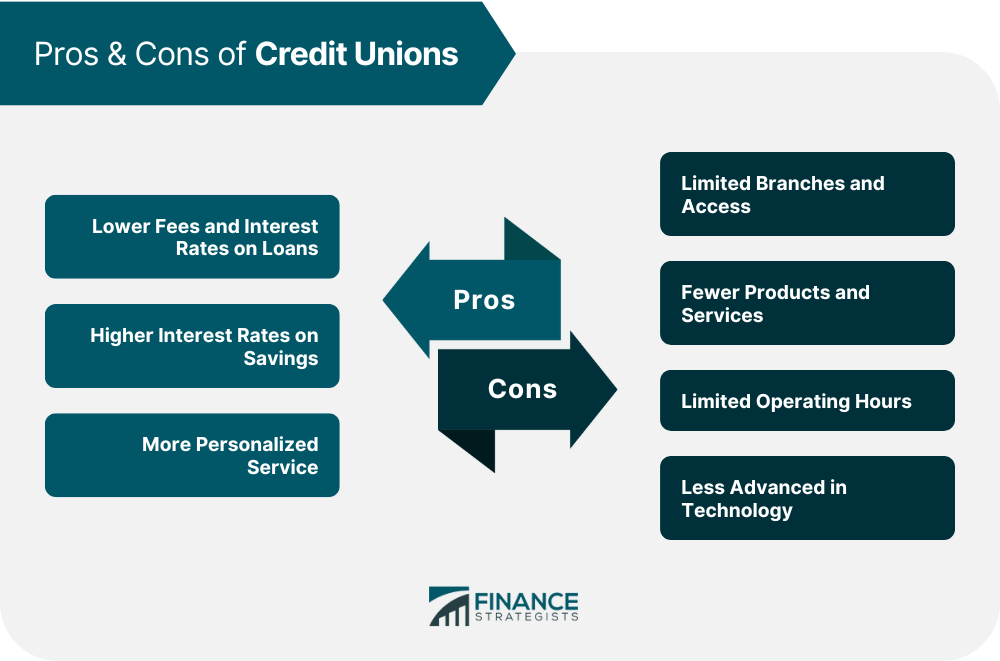

Debt unions are understood for supplying affordable rates and reduced fees compared to conventional financial institutions, offering participants with affordable financial options. One of the essential benefits of credit unions is their not-for-profit condition, permitting them to prioritize member benefits over making best use of profits. This distinction in framework usually translates into far better rate of interest on interest-bearing accounts, reduced rates of interest on car loans, and minimized charges for various services.

Personalized Financial Services

With an emphasis on conference private monetary requirements, lending institution succeed in giving customized monetary services tailored to enhance participant complete satisfaction and financial success. Unlike standard financial institutions, debt unions focus on understanding their members' distinct monetary situations to offer personalized remedies. This tailored strategy allows cooperative credit union to supply a series of solutions such as individualized financial recommendations, customized lending choices, and personalized cost savings strategies.

Members of credit scores unions can take advantage of individualized economic services in various means. For instance, when seeking a finance, lending institution consider factors past just credit report, taking into account the member's history and details needs. This approach typically leads to more desirable lending terms and greater approval rates compared to financial institutions. In addition, credit scores unions use individualized financial guidance to help participants achieve their monetary objectives, whether it's conserving for a significant purchase, intending for retirement, or boosting credit report.

Neighborhood Assistance and Engagement

Emphasizing public participation and cultivating interconnectedness, cooperative credit union proactively add to their neighborhoods through robust assistance initiatives and significant interaction programs. Community support is at the core of cooperative credit union' worths, driving them to exceed just monetary services. These organizations often participate and organize in different regional events, charity drives, and click here to find out more volunteer tasks to offer back and strengthen the communities they serve.

One method cooperative credit union show their commitment to neighborhood assistance is by providing financial education and proficiency programs. By providing resources and workshops on budgeting, saving, and investing, they equip people to make educated economic decisions, eventually adding to the general health of the community.

Moreover, lending institution frequently companion with local organizations, schools, and nonprofit organizations to attend to specific community requirements. Whether it's supporting small organizations through financing programs or funding academic campaigns, credit scores unions play an essential function in driving favorable modification and cultivating a feeling of belonging within their areas. Through these collaborative initiatives, lending institution not just improve monetary success however likewise grow a more inclusive and resilient society.

Structure a Strong Financial Structure

Establishing a strong economic base is necessary for long-term success and security in individual and organization finances. Building a strong monetary structure entails a number of key parts. The primary step is developing a practical budget plan that describes earnings, financial investments, financial savings, and expenses. A budget acts as a roadmap for economic decision-making and helps people and organizations track their financial progress.

Alongside budgeting, it is important to develop a reserve to cover financial troubles or unanticipated expenditures. Normally, monetary professionals recommend conserving three to 6 months' worth of living expenses in a conveniently obtainable account. This fund offers a safeguard during tough times and stops individuals from going right into financial debt to manage emergencies.

In addition, taking care of financial debt plays a substantial function in solidifying monetary foundations. Wyoming Credit Unions. It is vital to keep financial obligation levels manageable and work in the direction of repaying high-interest financial debts as promptly as feasible. By lowering debt, businesses and people can maximize extra sources for investing and conserving, inevitably reinforcing their monetary setting for the future

Final Thought

Finally, cooperative credit union play an important role in advertising economic success through Find Out More their distinct benefits, click here to find out more consisting of competitive rates, individualized solutions, neighborhood support, and economic education and learning. By focusing on participant contentment and proactively involving with local neighborhoods, lending institution help individuals and services alike develop a solid monetary structure for long-lasting prosperity and stability. Signing up with a lending institution can be a strategic choice for those seeking to achieve financial success.

This devotion to member solution can result in tailored monetary options, such as individualized car loan options or monetary education programs, to help members attain their financial objectives.

A spending plan serves as a roadmap for economic decision-making and assists individuals and organizations track their economic development.

In conclusion, credit rating unions play a crucial duty in promoting economic success with their distinct advantages, including affordable rates, personalized solutions, community assistance, and financial education.

Report this page